Mastering the Checkout Challenge - Past - Present - Future

Are you curious to find out what's new in the land of digital commerce and checkout? What has changed post-pandemic? How can you benefit from this knowledge? We've got the latest scoop on how to optimise your digital checkout and profit from the latest findings, forecasts, trends and research.

Past, Present and Future: The State of the Global Checkout

As we jumped headfirst into pandemic lockdowns in 2020 and 2021, we saw a distinct boost to ecommerce sales as many businesses turned to online sales during the lockdowns and it seems that this trend has been here to stay. After a temporary slump post Covid in 2022/2023, the eCommerce online share of the total retail market is expected to reach a record high of 21% by 2028.

With a predicted 39% growth in global eCommerce sales by 2027 (BigCommerce, 2024) and an annual growth rate of +9.49%, resulting in a market volume of US$ 6,478 billion by 2029, it's little surprising that everyone craves a slice of that delicious cake (Statista, 2024).

Yet at the same time, optimising the checkout process will continue to present one of the ultimate challenges to eCommerce retailers as consumers expect more from the experience.Having thoroughly analysed the key trends set out in this report, we present you with the most effective strategies enabling you to make the most of your checkout journeys and maximize returns. After all, if recent times have taught us anything, it is to prepare for everything and expect anything.

Off to a Fresh Start: Post Pandemic eCommerce

The pandemic forced businesses to reassess the world of online shopping as it encouraged more first-time shoppers to head online.

Following the loosening of pandemic limitations in 2021, the retail world saw a steady slope in online sales by 2022, as people eventually set back out into the physical world. Even if online shopping lost a bit of its charm in 2022, overall, consumers continued to appreciate the convenience of digital shopping - and that is expected to stay so through 2024 and 2025 (Trade.gov, 2024).

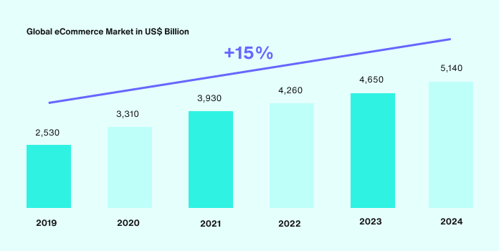

The global eCommerce market is projected to reach a value of US$ 5,140 billion in 2024, having grown by an annual 15% since 2019 (ECDB, 2024). However, this growth has come with a shift in consumer expectations, thus: eCommerce retailers have to adapt to meet the r growing demand.

So what does the future hold for online shopping? How will the changing need of consumers be met? What disruptions are to come? And most importantly, what will consumers be

expecting?

Diving deep into these questions, our report delves into the opinions and behaviours of global consumers, while presenting you a range of data from distinct markets including the US, UK, and EU.

The global eCommerce market - value in US$ billion

Source: https://ecommercedb.com/pdf/whitepaper/ECDB_State-of-Digital-Retail_Global-eCommerce-Market-2024.pdf

Crushing Cart Abandonment

From add-to-cart, to cart abandonment, to conversion

Global cart abandonment rates remain alarmingly high with billions of pounds lost every week due to consumers deserting their online purchases

On a global average, customers abandon their cart three times before making a purchase.

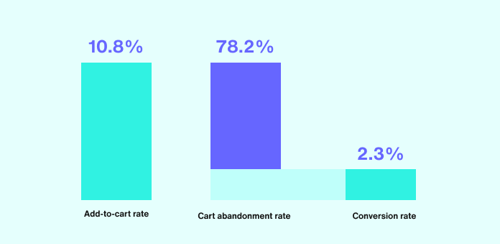

Following every first customer visit of an online store, user numbers decrease progressively at each stage of the conversion funnel. Only 10.8% of all global users add an item to their shopping cart during a visit.

Only a minor share of users with an item in their cart actually proceed to the checkout. 78.2% of visitors abandon the cart without buying. Plus, on average, customers abandon

their cart three times before hitting the “buy” button (with fashion and care products, this number is even higher). That means only a small number of people end up sealing the deal the first time around, with just 2.3% eventually buying cart contents in total.

Although the ongoing shift towards eCommerce means that more low-intent shoppers are visiting sites, the importance of eCommerce sales makes it crucial for brands to bring abandonment rates down, even those who may have arrived only to virtually window shop.

Global online cart abandonment & conversion rates

What are the top reasons for cart abandonment?

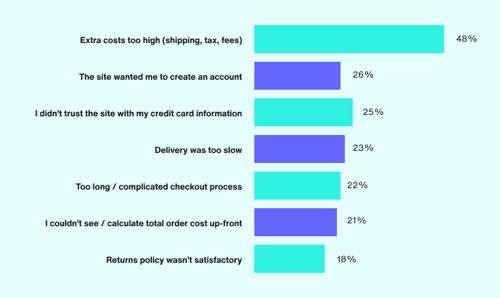

A Statista survey performed in 2024 revealed this: Approximately 41% of global online shoppers abandon their carts due to excessive delivery fees. Another 30% of shoppers crash their carts due to unexpected costs at checkout, or because they discovered cheaper items elsewhere (Statista, 2024).

In the US specifically, in 2024, almost 50% of consumers abandoned their online checkouts because of additional costs, such as shipping, taxes, or fees.

Numerous US shoppers also shy away from online purchases as they are asked to create an account or the process involves slow delivery.

Similarly, a 2023 survey with European consumers shows that delivery costs are the key reason for cart abandonment in this particular region. Delivery cost leaving to a product then being too pricey makes 50% of European shoppers want to shop elsewhere. Payment issues is also a key factor, with 27% of Europeans withdrawing from an online purchase when their favoured payment method is not offered (Statista, 2023).

What are the main reasons US consumers quit an online checkout?

Source: https://www.statista.com/statistics/1228452/reasons-for-abandonments-during-checkout-united-states/

Deliver Decency

What do consumers value most with deliveries?

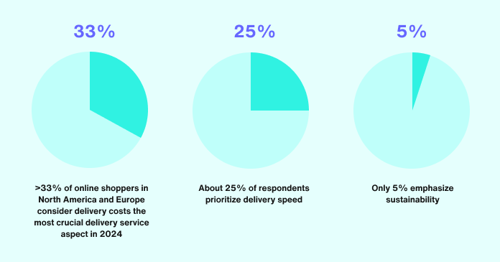

There are many incentives for shopping online among web users across the world. Let us give you the key ones, so you are better equipped to turn confusion into conversion. The top reasons for consumers intending to shop online include the freedom to shop at any time and doing so from home. Speaking of “convenience”… Further motivators include sustainability, secure tracking and packaging, and most importantly: free delivery options (Statista, 2024). So next time you bang your head over those staggering cart abandonment rates, make sure to think “delivery first”.

What are consumers’ main priorities for delivery in online shopping, 2024 (US & EU)?

Source: https://www.statista.com/statistics/1472017/most-important-delivery-aspects-online-shopping/

Consumer Cravings Unlocked – What Do Consumers Really Want?

Hey, Big Spender?! How much consumers spend online.

The global average order value for eCommerce purchases has significantly soared over recent years, from around US$ 118 in September 2022 to around US$ 126 in the same month of 2023.

The average order value depends greatly on the online traffic source used by consumers.

In 2023, the value per order was the highest when navigating directly (i.e. searching for a website directly in the browser's address bar, without using a search engine), totalling around US$167. Purchases made from social media stores had the lowest value, averaging US$ <110.

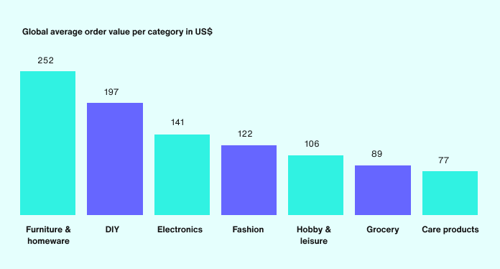

Plus, there is a distinction between categories, with consumers spending by far the most on large purchases, such as furniture (US$ 252), DIY products (US$ 197), electronics (US$ 1412) and fashion (122 US$), less so on grocery and care products.

Global average order value across categories, 2024

Mobile shopping on the rise

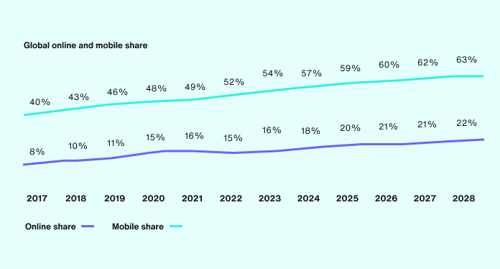

In 2023, revenue from mobile eCommerce sales reached an estimated US$ 1.7 trillion, accounting for over 50% of all retail eCommerce sales. Mobile shares of shopping values

have consistently increased over time, rising from 43% in 2018 to a projected 63% by 2028, when almost two thirds of consumers are expected to shop via mobile devices.

However, when it comes to online shopping purchase values, desktop continues to top the leaderboard with an average order value of US$ 170. So: The bigger the purchase, the more likely consumers refer to their desktops. Another interesting fact: according to Statista, consumers are more inclined to complete orders when shopping via mobile gadgets.

Global online vs. mobile checkout shares,2017-2028

Checkout technology turnup – What do consumers expect moving forward?

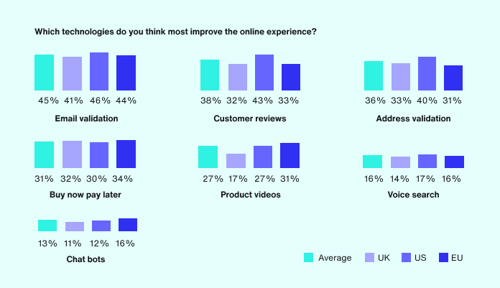

According to research conducted by Loqate, email and address validation are the best ways to improve an online checkout. 45% and 36% of respondents view them as top

technologies. However, according to an eCommerce UX benchmark conducted by Baymard (2024), 32% of global sites fail to provide any field validation at all. What’s worse:

Global value of US$ 3.7 billion. With chatbots valued by 13%, it’s no surprise that global spending on this technology is projected to total US$ 72 billion by 2028. Voice Commerce equals 16%, with 75% of US households expected to own a smart speaker by 2025.

The same trend applies to alternative payment methods, such as express checkouts and digital wallets. In fact, it is projected that there will be more than 5.2 billion users of digital wallets worldwide by 2026, corresponding to a 53% growth compared to 2022.

Which technologies do you think most improve the online experience?

Source: Loqate research, 2021

Delivery magic – What consumers expect from deliveries moving forward

Fast, convenient, transparent, sustainable, and free. That is how consumers worldwide expect their online shopping delivery experience to be: full of options.

When surveyed about their interest in various delivery service options, 37% of online shoppers expressed interest in delivery services combining multiple orders into a single

delivery at the end of the week. Similarly, 36% preferred combining orders into a single delivery when there are multiple deliveries in their area. 20% would pay for faster shipping and more convenient delivery times (Statista, 2024).

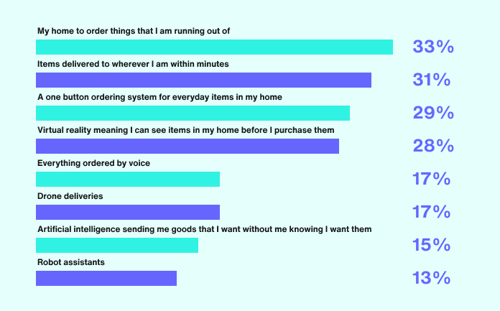

Plus, according to previous research conducted by Loqate, consumers are most keen on automated deliveries, dynamic deliveries and one-tap ordering. 33% would like their home to order things when they run out, 31% want items delivered quickly to wherever they are, and 29% would like a one button ordering system for items at home.

What do global consumers want to see in the future online shopping delivery experience?

Source: Loqate research, 2021

Top 5 Features of Future Checkouts

Want to be ahead of your competitors and right in front of your customer? Consider these:

1. Smart home ordering: Our research found the most desired innovation was smart home ordering, otherwise known as automated replenishment - where purchases are automatically refilled before you run out - as chosen by 33% of respondents. It’s easy to see the appeal, as it offers an effortless way of ensuring that families are never short of essential items.

2. On demand delivery: Only slightly behind smart home orders was dynamic address delivery. 31% of consumers love the idea of having items delivered to where they are at that moment in time, as soon as possible. As people return to offices, visit other people’s homes and shared spaces, they will want their items delivered to them wherever they are.

3. One button ordering: While appropriate friction is useful in some cases, the convenience of simply pressing a button on an item to order was appealing to 29% of consumers. Again, there is an element of convenience similar to the smart home ordering, but there is an extra layer of customer confidence in the physical pressing of the button opposed to the automation of smart home ordering.

4. Virtual reality: People were extremely keen on the idea of visualising purchases in their home before they bought them, so it’s no surprise that 28% of respondents chose a VR option for their most-desired technology. As the technology becomes more accessible, it is easy to see how it could seamlessly fit into purchasing luxury goods, clothing and items such as furniture.

5. Drone deliveries: Over 17% of consumers believe that drone deliveries will be helpful, highlighting that delivery remains a core component in online retailer’s efforts to differentiate their brands in an increasingly crowded market.

The retail landscape is rapidly evolving to meet changing consumer needs. In 2023, 74% of industry professionals expected the act of shopping to become a process that consumers can engage in anytime, anywhere and on any platform – resulting in major investments in digital customer experiences. However, retailers also prioritise enhancing the in-store shopping journey, accelerating innovations across both online and offline channels.

Our research has outlined the challenges and opportunities surrounding retailers. Brands that allow consumers to shop where they want, when they want, and how they want, will succeed in an increasingly crowded digital marketplace.

Retailers’ Digital Must-Haves: Top Features Shaping the Future Checkout

Source: Loqate research, 2021

Say “Hi” to Social Shopping Sprees:

According to a recent Euromonitor study (2023), one in three retail industry professionals enable purchases through social media transactions. Driven by platforms like Instagram, Facebook and TikTok, social commerce has rapidly become a leading force in the eCommerce space, and is projected to grow annually by 31% for years to come, totalling US$ 6.2 trillion by 2030.

It’s That Simple! Simplified Shopping:

Today’s all about streamlining the shopping experience by implementing the most frictionless checkout possible. Eliminating pain points and enhancing overall customer satisfaction – just two of the perks granted by tec pioneers like AI, which further facilitates product discovery or personalised promotions such as coupons and loyalty-based discounts. 57% of retail industry professionals currently view the advancement of customer experience as their strategic priority (Euromonitor, 2024).

Getting Personal with Personalisation:

Needless to say: Personalization boosts customer loyalty. A study by Google and Storyline Strategies revealed that 72% of consumers are more likely to be loyal to a brand if they offer a personalized customer experience. Hence for many retailers, it’s all about creating a seamless omnichannel experience that engages the customer at every touchpoint – and personalising product offers based on personal preferences, including past purchases or user profiles, has become a must.

It’s a Numbers Game – Data-Driven Retail:

Retailers and brands have long understood the potential of data, advanced algorithms, and AI to improve customer experiences. This includes inventory management, supply chains, pricing, marketing, and more. No wonder 43% of retail professionals recognised AI as the most influential technology in retail in 2023 (Euromonitor, 2023).

How Loqate Can Help Build the Checkout of the Future

An easy way to optimise your checkout experience and grow your revenue

A huge part of the checkout process moving forward will be gaining the trust of consumers, and Loqate will help you procure this trust through our innovative validation technology. Our location intelligence data helps over 20,000 businesses of all sizes ensure that their customers have the best possible experience.

Find out how address verification could improve your results by getting in touch with us today.

Sign up for a free trial through our website or get in touch with one of our advisors.

Summary

Checkout design and user experience are THE decisive factors in your eCommerce success – especially in recent times, when entire industries and markets have been struck by a pandemic, shifting consumer needs and banging new technologies.

With customer behaviour and technologies changing by the minute, checkout optimisation must be a continuous process. In other words, retailers need to always stay in tune with the

latest good practice. By that we mean: Regularly audit your checkout process end-to-end and create a task list of improvements, test changes and measure the impact. Then do it all over again.

The detailed research presented in this report will keep you in the loop on the most striking trends, issues and challenges – including post-pandemic scenarios, cart abandonment and

consumer needs – surrounding the lands of global ecommerce and checkout. Most importantly, our goal is to equip you with effective strategies empowering you to make the most of your customers’ checkout experiences and sustainably maximize your revenues.

Methodology:

Official research from trusted sources, like Statista, ECDB, BigCommerce, Baymard Institute and more.

Own research commissioned by Loqate and conducted in May/June 2021 by Perspectus Global, comprising of: 1,000 UK respondents, 2,000 US respondents, and 250 respondents from Netherlands, Spain, Germany, France, and 250 Italy respectively. 150 eCommerce decision makers of global businesses.