A leading global online food delivery marketplace was struggling with 600,000 incorrect addresses being input into their system each week, causing an increase in delivery delays or failures and costing £24m per year in the UK alone.

Experience verified data that transcends seasons

Set your business up for success with a solution that transcends seasons. Loqate’s data verification helps you improve efficiencies, increase revenue and build lasting customer relationships.

Get a demo

The cost of dirty data

From failed deliveries to wasted marketing and onboarding efforts, dirty data is bad for your bottom line.

£10.2mil

lost by businesses annually due to poor data quality

£156,762

spent every year by UK retailers due to data-related failed deliveries cost

54%

of consumers have stopped buying from a company due to data concerns

The gift that keeps on giving

Our solution captures, verifies and enriches data to help companies achieve substantial savings throughout the year.

Global food platform saves millions with Loqate

600,000

incorrect addresses collected per week

£24m

per year saved with Address Capture

Challenge

Solution

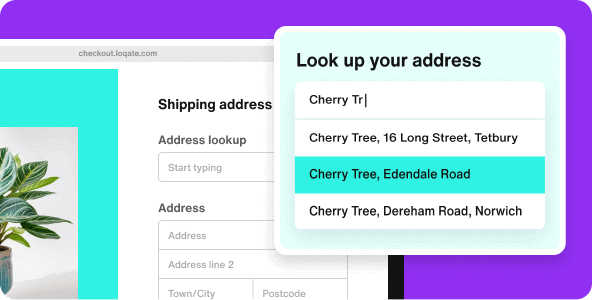

Using Loqate to collect verified addresses during data entry caused a significant decrease in failed deliveries. Our Single Line Type Ahead Search capability enabled customers to quickly undertake an address search within the checkout, reducing the amount of data they need to enter before finding their address and ensuring that the returned data is valid and deliverable by the courier.

Footwear brand saves customer workers' time

7.5hrs

hours of customer service time saved per week

£30,000

saved per year

Challenge

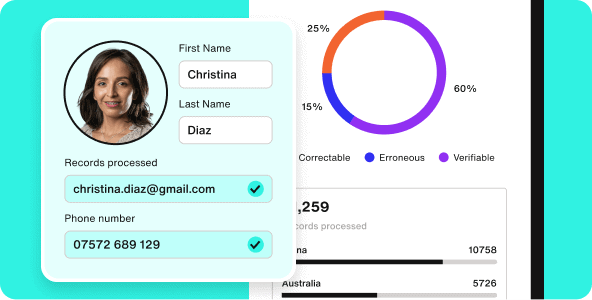

A famous footwear company faced an increased number of inbound customer service queries due to failed or lost deliveries, resulting in an additional 7.5hrs of time spent handling queries each week for their customer service team.

Solution

This brand created a direct line to their customers with the help of Loqate’s Email and Phone Validation solutions. By capturing higher-quality email and phone data at the point of order, they minimised the troubleshooting steps for customer service and helped them contact and get to a resolution with the customer that much quicker. This improved efficiency in handling queries resulted in annual savings of over £30k.

eCommerce platform reduces email bounces

25%

reduction in email bounce rates

£1m

per year saved in incremental revenue

Challenge

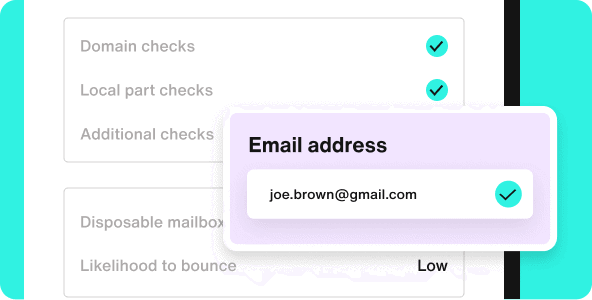

An online furniture retailer experienced high bounce rates that negatively impacted their marketing campaign involving a £10 gift voucher giveaway. Poor email address data meant customers didn't receive their voucher, costing the company £1m per annum of incremental revenue.

Solution

The brand chose Loqate’s email validation capability to save their email lists and marketing efforts. They began with email data hygiene, identifying and removing fake or invalid email addresses and checking their list for accuracy to maintain a good sender reputation. Then real-time verification was implemented to prevent bot sign-ups and ensure only valid emails entered their systems going forward.

Mobile network reduces customer drop-off with reverse geocoding

25%

more addresses correctly verified

300%

ROI after implementing Loqate

Challenge

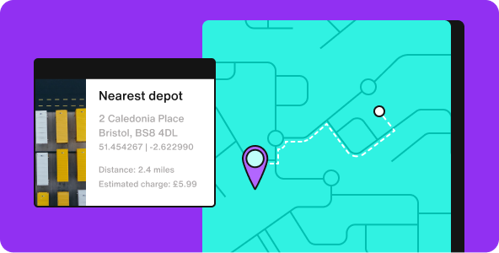

A well-known mobile network wanted to enhance their existing address capture forms, which were causing significant loss in customer orders as customers were not pressing the ‘Find address’ button after manually entering their postcode in their address lookup.

Solution

The company saw an improved user experience with a 25% uplift in members entering correct addresses since choosing Loqate’s type-ahead search and reverse geocoding functionalities. In addition to more natural search functionality, they saw a further 2% reduction in online customer drop-off when using reverse geocoding to accurately identify a location nearest to a latitude and longitude coordinate, increasing location data reliability.

Optimise your data quality with these products

Address verification

The most reliable way to onboard your customers and enhance the quality of your existing data.

Data maintenance

Guard against fraud, stay connected with customers, increase revenue and reduce costs.

Store Finder

The easiest way for your customers to quickly find your physical locations anywhere across the globe.