Fighting fraud with accurate location data

This article originally appeared in Fintech Magazine

In the realm of payments and identity verification, an individual's address is a crucial data point used in confirming their identity – and is a key piece to fraud signals and fraud data models.

In today's global, interconnected and digital-first world, cross-border payments are becoming more common. As their frequency increases, they expose shortcomings in the traditional payment, fraud and identity solutions. As you bring your cross-border footprint to scale, improving address verification rates has become crucial to reducing friction in this process.

The real numbers behind the efficacy improvements are quantifiable. It gives fintech providers and businesses transacting internationally greater certainty and predictability in their fraud data models.

Fraud knows no borders: the importance of address data in cross-border payments

As financial institutions navigate this new landscape, addressing the challenge of fraud detection and prevention will be critical to maintaining customer trust and security. This is especially challenging because, just as technology evolves, so do fraudsters’ methods.

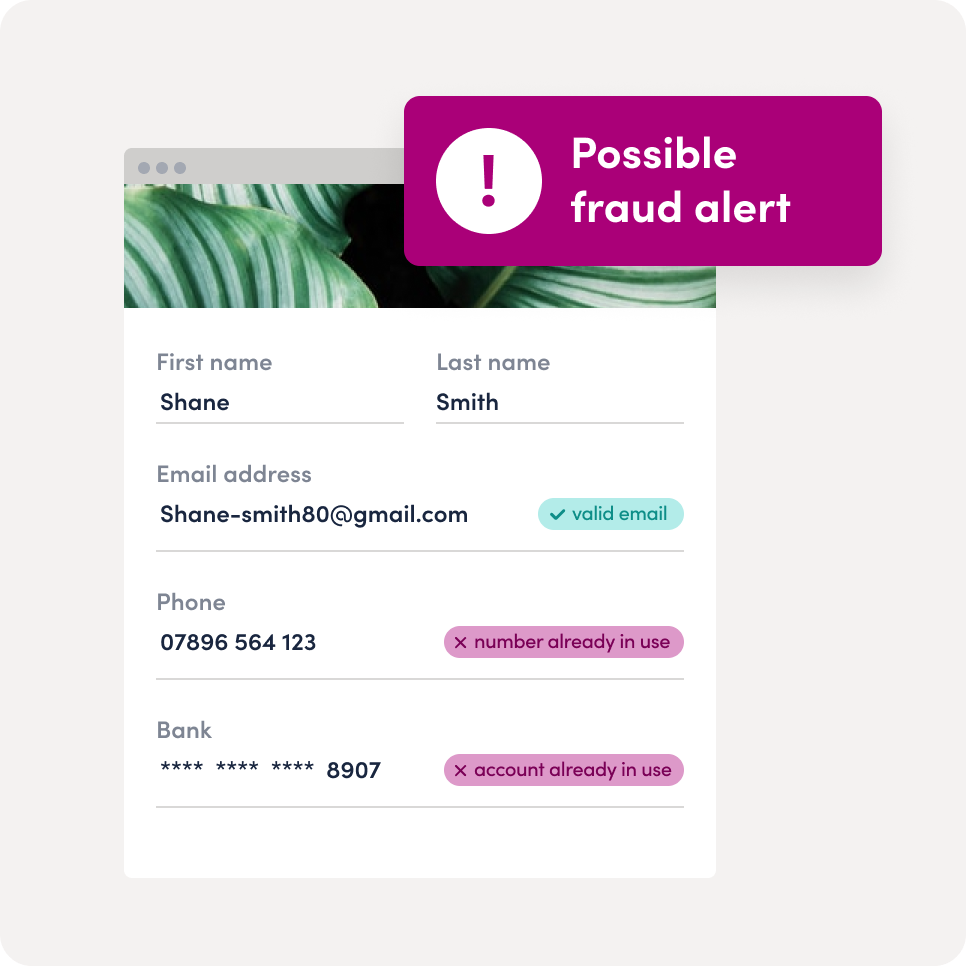

Loqate is helping fintech companies meet the moment by combating fraud without compromising customer experience. While an address is just one component of a fraud signal, address verification is a crucial element to help companies successfully build their data model. The net result is higher match rates, which leads to reduced false positives.

By using more accurate data signals, you will improve your data models, deliver more predictable match rates, and reduce the instances of false fraud alerts. In short, address verification is a key piece to the fraud prevention puzzle.

The complexity of global addresses

With over 130 different address formats across 249 countries and territories, address verification is a challenging task. Only a handful of countries have a standard postal address format. Many regions around the world use different ways to describe a location – such as neighborhood names, points of interest or directions to a location, injecting noise into the data.

Loqate’s API solves this problem by combining the richest globally curated data from various sources including postal, geospatial and local sources around the globe. This, coupled with a sophisticated matching and verification engine, ensures the highest possible match rates and uplift. The result is verified address data, parsed, standardized, enriched and structured to the most appropriate local format.

In conclusion, businesses across industries need the precision and reliability they need to make location data-driven decisions, deliver superior customer experiences, help prevent fraud and enable cross-border payments and commerce – globally and at scale.